Mesothelioma and Asbestos Trusts, Settlements

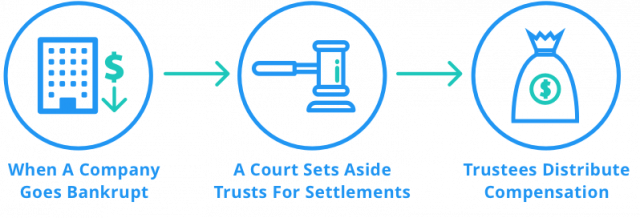

Many companies with large exposures to asbestos-related claims have chosen to file for bankruptcy and set up trusts to compensate claimants. If a company responsible for exposing a person to asbestos, which resulted in a mesothelioma diagnosis, has set up a trust, people can file a claim with the trust instead of filing a lawsuit against the company.

- Legally reviewed by William A. Davis, Esquire

- Last update: September 5, 2023

Beginning in the 1970s, lawsuits against companies that exposed their workers to the toxic mineral asbestos flooded the U.S. court system, and the number of claims grew at a rapid pace. By 2002, some 730,000 people had filed asbestos-related lawsuits against companies that knowingly exposed their workforce to asbestos.

One result was nearly $49 billion in compensation for plaintiffs and family members. Another was that nearly 100 companies were driven into Chapter 11 bankruptcy. As a condition of reorganization to emerge from bankruptcy, many of these companies were ordered to establish personal injury trusts so that they can continue to compensate those injured as a result of their past negligence.

A trust is a legal arrangement that lets a third party, called a trustee, hold assets on behalf of beneficiaries. Asbestos trusts are funded by the companies going into bankruptcy to provide funds to pay current and future asbestos claims.

A bankruptcy court determines the amount of money that should be set aside for the trust based on expert testimony and an examination of past lawsuits and settlements. The trusts are managed by independent trustees who decide how much compensation to pay claimants.

Corporate Bankruptcies and Asbestos Trusts

Once a company creates a trust, claimants can no longer file lawsuits against it. Instead, they must file a claim with the trustees. The trustees operate the trust to benefit future claimants.

The first asbestos trust was set up in 1988 by Johns Manville. Through 2010, a total of 96 companies had declared bankruptcy with some asbestos liability. Fifty-four of them had created trusts as part of the process of emerging from bankruptcy. Many others were and are still going through that process.

Since then, millions of claims have been filed with the more than 60 trusts, and nearly $20 billion has been paid to claimants. As of 2013, the trusts held more than $18 billion in assets, with another $11 to $12 billion designated for trusts still in the process of emerging from bankruptcy.

| Company | Amount in Trust | Payment Percentage | Established |

|---|---|---|---|

| W.R. Grace & Co. | $2.3 billion | 35% | 2014 |

| Armstrong World Industries | $847 million | 19.7% | 2006 |

| DII Industries | $1.5 billion | 60% | 2007 |

| USG Corp. | $1.1 billion | 12.7% | 2006 |

| Owen Corning Fireboard | $975 million | 4.4% - 5.9% | 2006 |

| Combustion Engineering | $446 million | 18.5% | 2006 |

| Kaiser Aluminum | $361 million | 18.1% | 2006 |

| Johns Manville | $533 million | 5.1% | 1987 |

A mesothelioma patient whose cancer can be traced back to a particular company may wish to file a lawsuit in an attempt to gain compensation for their illness. But if a bankrupt company has established a trust to deal with medical claims for damages, the victim must file a claim through the asbestos bankruptcy trust – generally with the help of a lawyer familiar with mesothelioma and asbestos issues.

Filing an Asbestos Trust Claim

The protocol for filing an asbestos trust claim is slightly different for each trust, but the majority of trusts share the same six-step process:

Step 1: Identify the Trust

The first step is to identify one or more appropriate trusts according to your work history. You can file claims only with trusts set up on behalf of a company that exposed you to asbestos, whether that company produced, manufactured or simply used asbestos-containing products. Trusts refer to these companies as debtors.

Trusts have eligibility requirements designed to ensure that each trust provides compensation only for individuals who were injured as a result of exposure to asbestos from the debtor company for which it was set up.

Step 2: Gather Your Evidence

To be compensated by a trust you must prove you have an injury as a result of exposure to asbestos-containing products that were manufactured by the debtor.

- Medical records

- Get copies of X-rays, pathology reports and doctors’ notes that indicate you've been diagnosed with mesothelioma or an asbestos-related illness.

- Evidence of asbestos exposure

- If your exposure was a result of your employment at a location where asbestos was found, you need to present employment records, or if that’s not possible, affidavits from people who can testify to your presence. If you developed an illness based on a family member’s exposure, document the relative’s exposure to asbestos.

- Proof of exposure to the debtor's products

- Proof of exposure to asbestos is not enough. You must also show that the asbestos in question came from the debtor.

- Death certificate

- If the claim is on behalf of someone who’s deceased, you must provide the death certificate.

Step 3: Choose a Method of Review

Asbestos trust claimants typically have two options when deciding how their claims will be processed: expedited review and individual review.

In the expedited review process, claims are paid quickly and at a set value. The trust assigns a fixed payout for each asbestos-related disease, with more serious conditions valued higher than others. Trusts typically publish the scheduled value for each condition in a document called the Trust Distribution Procedure, or TDP.

Not all claimants qualify for expedited review. You need to support your claim with evidence, such as proof of your work history and medical documents pertaining to your diagnosis. After collecting this evidence, you send it to the claim-processing facility for review.

Some claimants prefer to file for an individual review. Although this method takes longer for the trust to process, it allows claimants to receive individual consideration for their cases. Your unique situation determines your award from the trust, which may or may not result in a higher payment than the fixed rates of the expedited review process.

Individual review is required when claimants fail to meet the medical or exposure criteria of the expedited review process. It may also be required for other situations, such as a diagnosis of asbestos-related lung cancer in a claimant with a history of smoking.

Step 4: Claim Review

Approximately six months before your claim enters the review phase, the trust will request recent updates on your health status and any additional evidence of asbestos exposure. When the trust is confident that your information is accurate and up to date, it will begin reviewing the evidence submitted for your case.

In claims filed for expedited review, the trust ensures that the claimant’s medical and exposure evidence meets the requirements laid out in the TDP. To make sure that claimants with similar diseases are compensated fairly and equally, trusts have established disease levels for each asbestos-related condition. Mesothelioma always appears as a separate disease level, but other disease levels may vary from trust to trust.

-

Disease Level 8

Condition - Mesothelioma

-

Disease Level 7

Condition - Lung cancer with evidence of asbestos-related nonmalignant disease in both lungs (typically asbestosis)

-

Disease Level 6

Condition - Lung cancer without evidence of asbestos-related nonmalignant disease in both lungs

-

Disease Level 5

Condition - Other cancers with evidence of asbestos-related nonmalignant disease in both lungs

-

Disease Level 4

Condition - Severe asbestosis

-

Disease Level 3

Condition - Asbestosis/pleural disease with significantly restricted lung function

-

Disease Level 2

Condition - Asbestosis/pleural disease without significantly restricted lung function

-

Disease Level 1

Condition - Other asbestos diseases, such as bilateral asbestos-related nonmalignant disease or an asbestos-related malignancy other than mesothelioma

Each asbestos disease level has its own set of medical and exposure criteria that must be met. If you meet the medical and occupational requirements laid out by the trust, your claim will be recognized as valid and advanced to the next step, liquidation.

Step 5: Liquidation

In this step, the trustees assign a monetary value to your claim. If you filed for expedited review, your claim will be liquidated according to the scheduled value of your disease level set forth in the trust’s TDP, regardless of your individual circumstances.

Individual review claims are typically assigned a value based on past awards from similar cases in the legal tort system. Factors the trust takes into consideration for determining this value include your age, your condition, the number of dependents you have, noneconomic damages you’ve sustained, and the settlement and verdict history of your law firm.

Once your claim is liquidated, the trust will provide you with an offer. You may choose to accept the offer and enter your claim in the payment queue, or you can refuse and have your claim entered into alternative dispute resolution, or ADR. In some cases, you have the right to file a lawsuit against the trust in the court system.

Step 6: Claim Payment

You will receive payment for your claim based on the date you were entered into the payment queue. Awards are given on a first-in, first-out basis. According to research by the RAND Institute for Civil Justice, the average value of a mesothelioma claim is $180,000.

To ensure that there is enough compensation available for future claimants, trusts discount awards by a rate known as the payment percentage. To determine your award, the trust will multiply the liquidated value of your claim by a set payment percentage based on a forecast of the trust’s total liability to present and future claimants. For example, if your claim was liquidated at $180,000 with a payment percentage of 20%, your actual award would be $36,000. Payment percentages will vary from trust to trust and are usually adjusted over time.

The RAND research says average award values for mesothelioma claims once the payment percentage has been applied range from $13,000 to $238,000.

Claimants are also responsible for paying attorneys’ fees for the award. While this amount also varies, the fee is typically 25% of your award.

The entire process can take from a few months to more than a year, not including the time you spend gathering the documents you need to file a claim.

Future Claims and Payment Percentage Adjustments

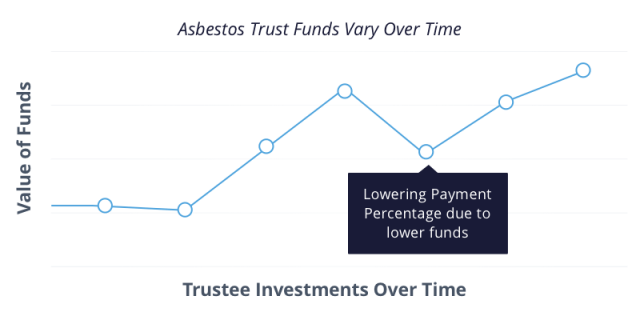

The amount of funds available in asbestos trusts varies over time. Trustees invest the money placed in the trusts, so the value may rise if the investments do well. But claims against the trust deplete its value. Trustees must plan to have enough funds to pay future claimants.

Periodically, trustees consider the trust’s investments and expenses, and forecast estimated future claims. They can adjust the trust’s payment percentage to a lower value if it appears they may be in danger of expending their funds prematurely.

Calling this number connects you with a Drugwatch.com representative. We will direct you to one of our trusted legal partners for a free case review.

Drugwatch.com's trusted legal partners support the organization's mission to keep people safe from dangerous drugs and medical devices. For more information, visit our partners page.